The service is provided by Ing. Samuel Zubo, ID no.: 75396602, Not regitered to VAT.

The main advantages of the service are:

Here are some recommendations:

Yes, after receiving the payment for order we will immediately send you email with the link for downloading the tax document - invoice in PDF format. We are not-registered for VAT since 11.1.2023.

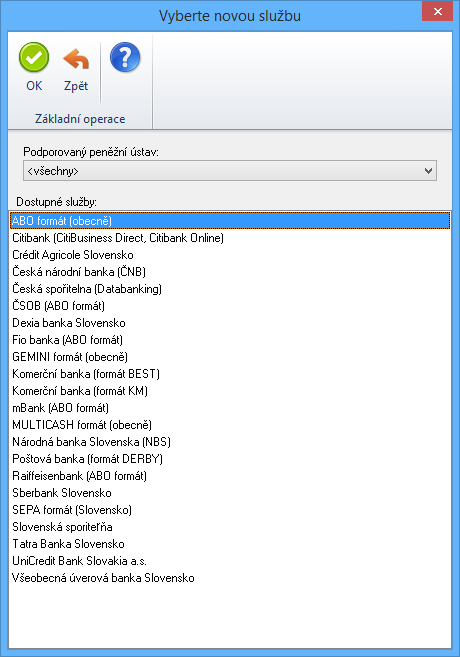

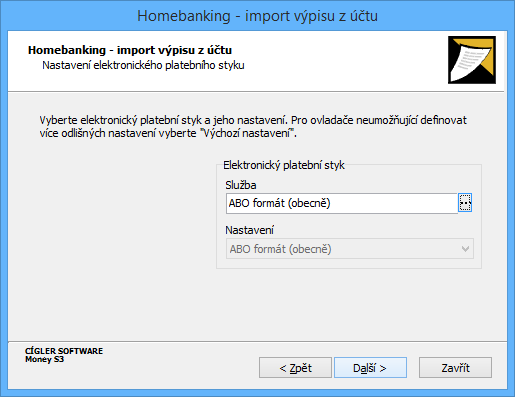

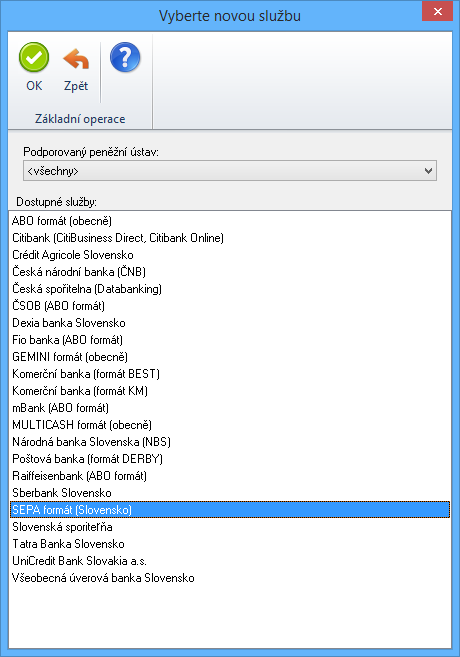

If your accounting software supports various formats for statements import, we basically recommend to use XML. However with following exceptions.

Accounting softwares are not perfect. Each one has some problem with certain statement format. Certain formats do not allow to insert into the accounting all data we would like to.

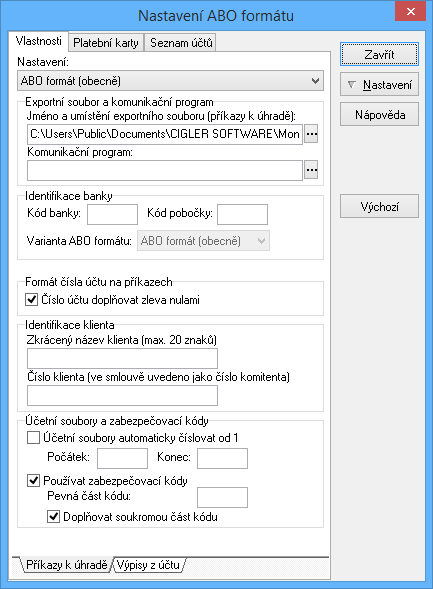

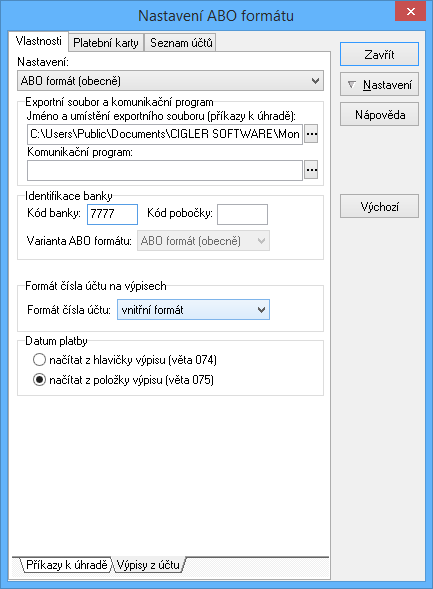

For XML it is possible to insert more information from original PayPal statements. Thus there will be more information in your accounting and your accountant will have a better overview of which payment is concerned and from whom the payment comes. Unfortunately ABO format do not allow inserting of some important parameters.

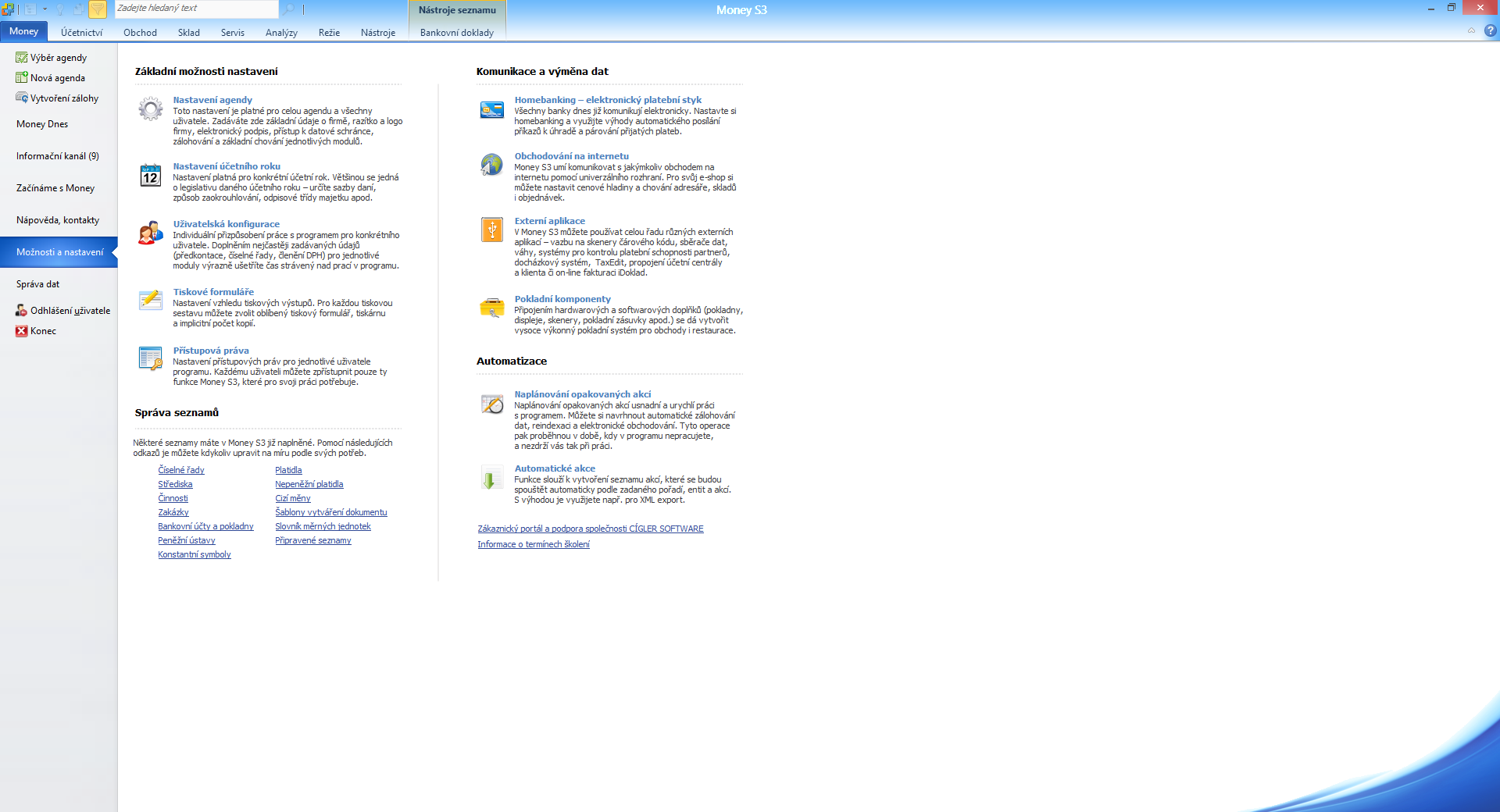

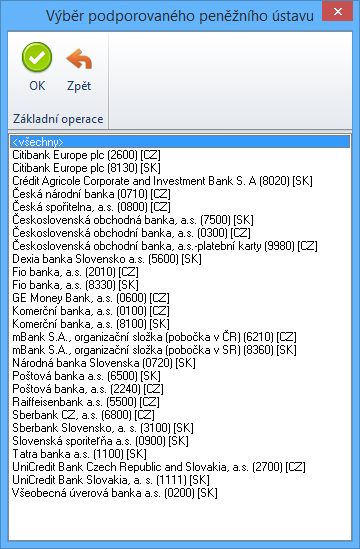

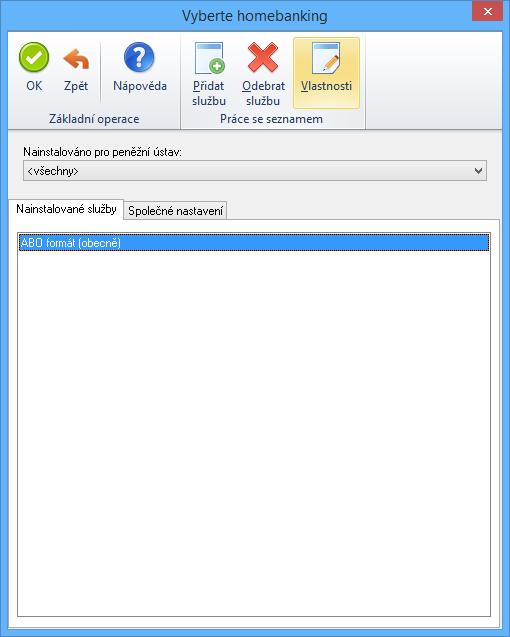

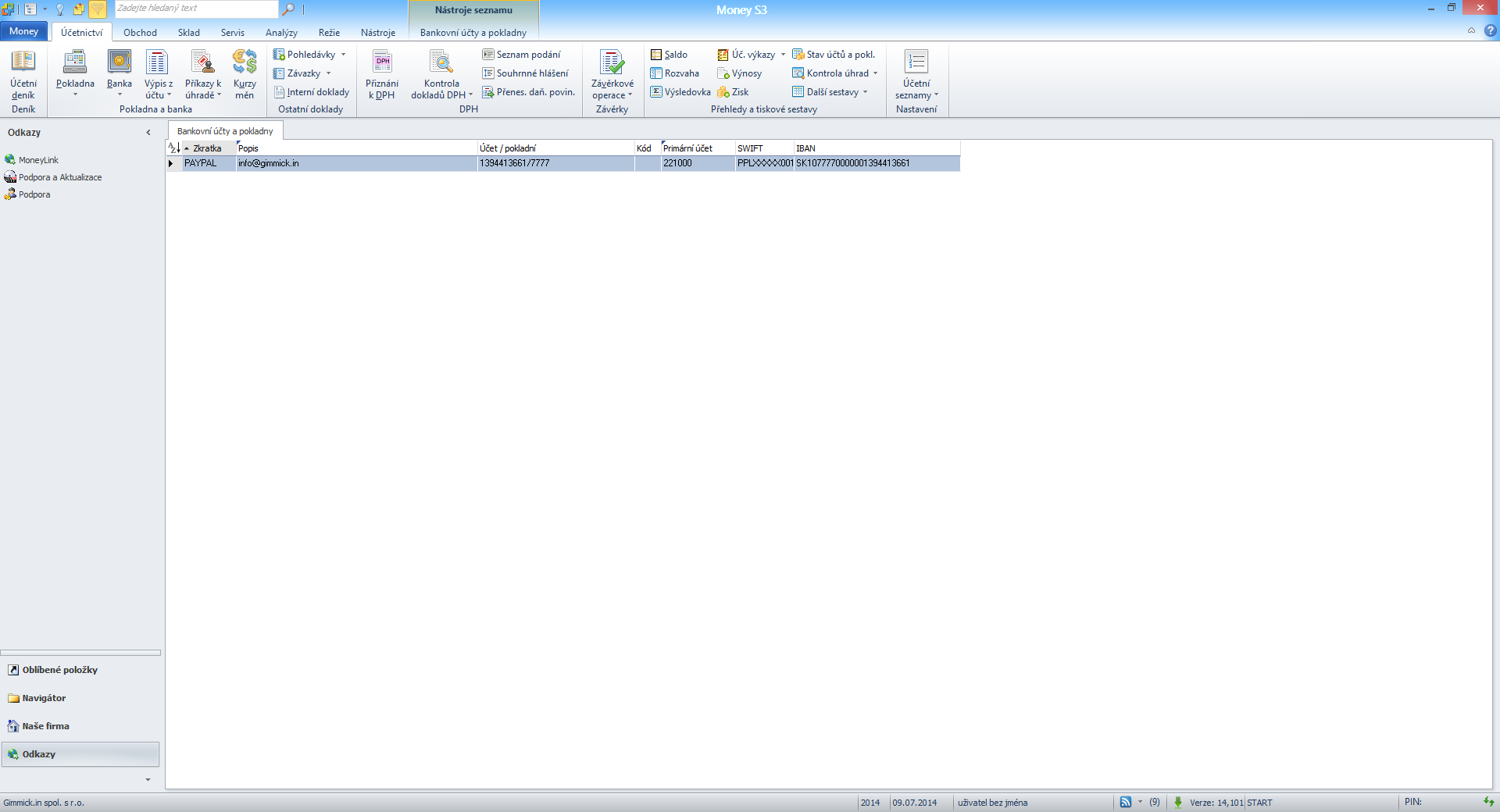

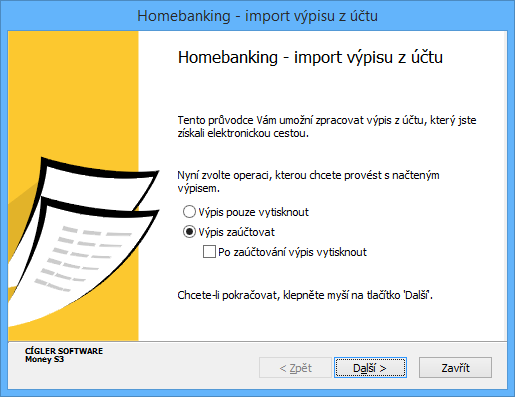

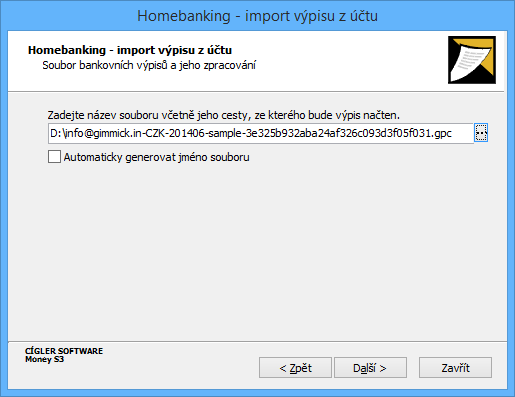

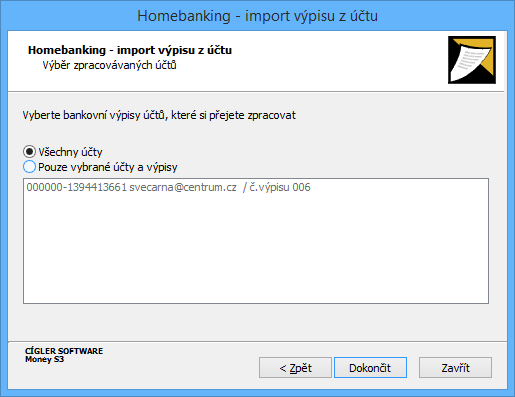

Therefore our recommendation for accounting software are following:

According to our experiences on standard hardware it is possible to save up to 98% of time with sofwares Money S3 or Pohoda. With faster programs or hardware the saving can be even higher.

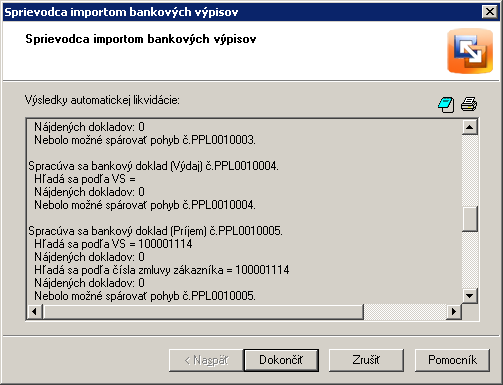

The "must" is correct using of the variable symbol. Variable symbol should have 10 digits in Czech republic and Slovak republic. If You use PayPal, Your eshop should send varibale symbol to payment gateway in the parameter <input type="hidden" name="invoice" value="'{variabilní symbol}'">. Yes it is confusing, as some companies use the variable symbol as customer ID, order ID, or invoice ID. In the statement from PayPal You will find these values in the column named: "Invoice Number". This value is necessary for pairing payments with invoices in the accounting.

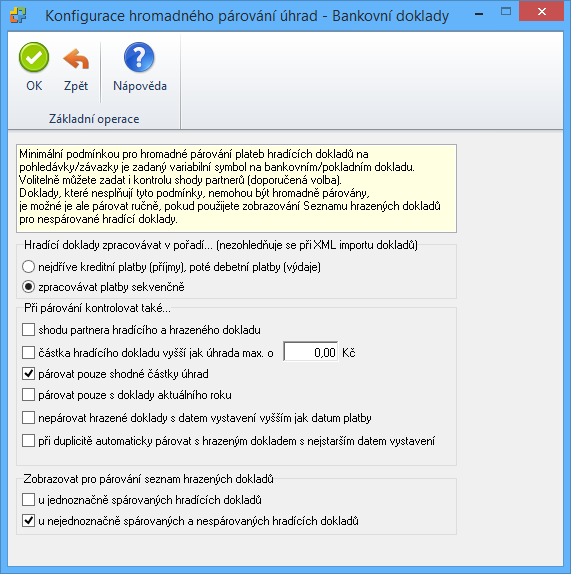

The rules for right payments can be adjusted in your accounting software. Usual requirements are:

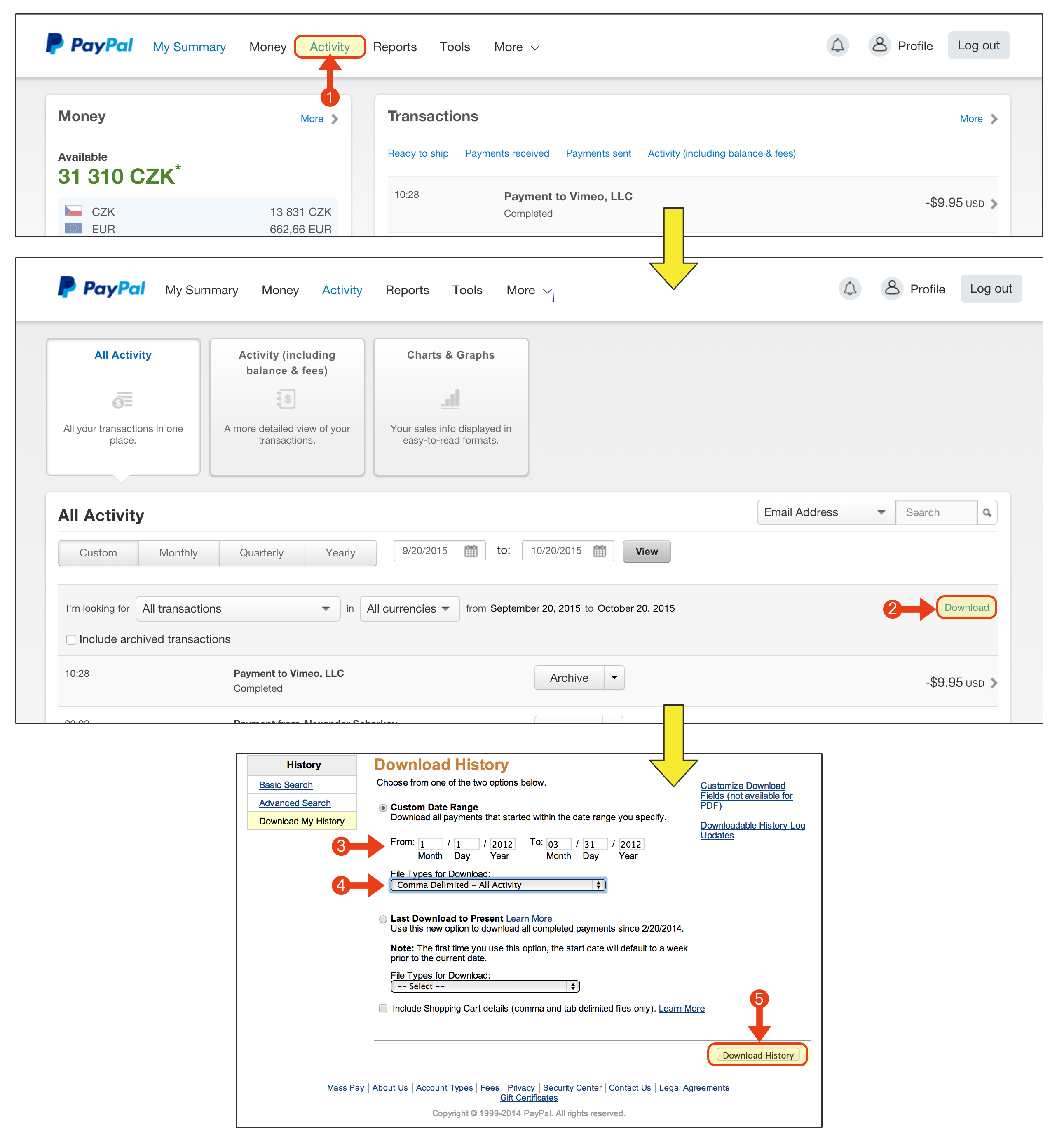

PayPal allows the different kinds of statements. The basic one is PDF format which contains niether variable symbol nor client data. In this case the easy payments matching is impossible and searching demands much time. The matching is even more complicated if the invoice is issued in a currency different from the currency in which the PayPal account is kept, because the amount in the invoice differs from the amount in the statement.

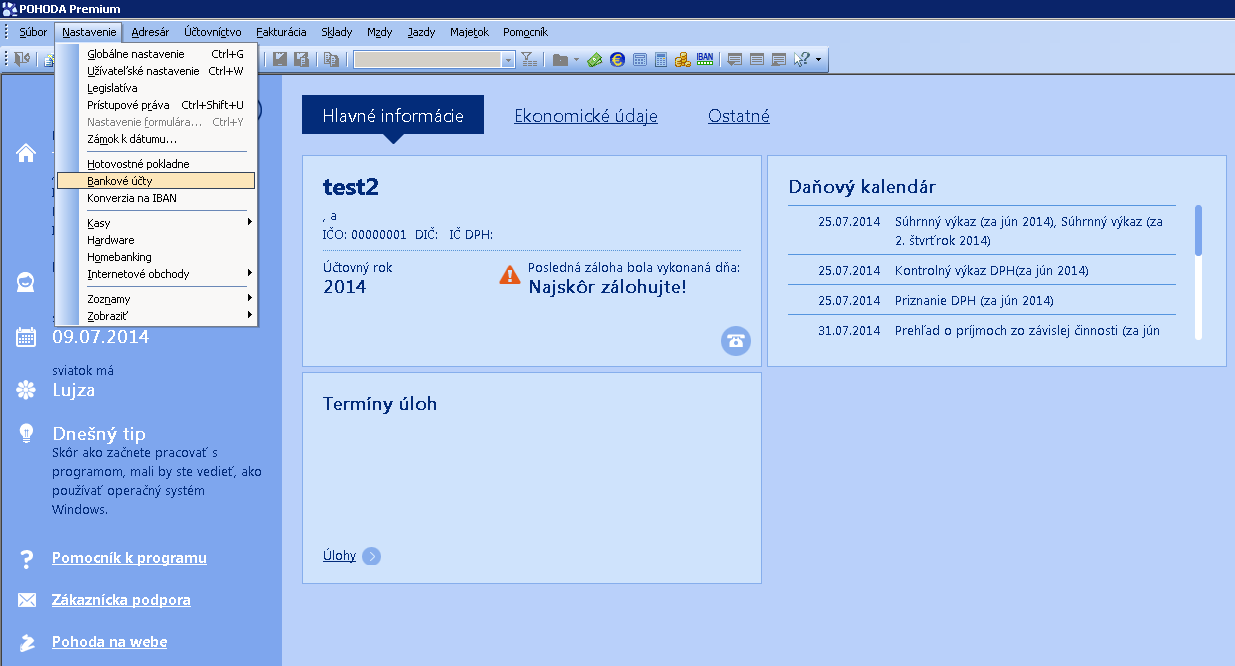

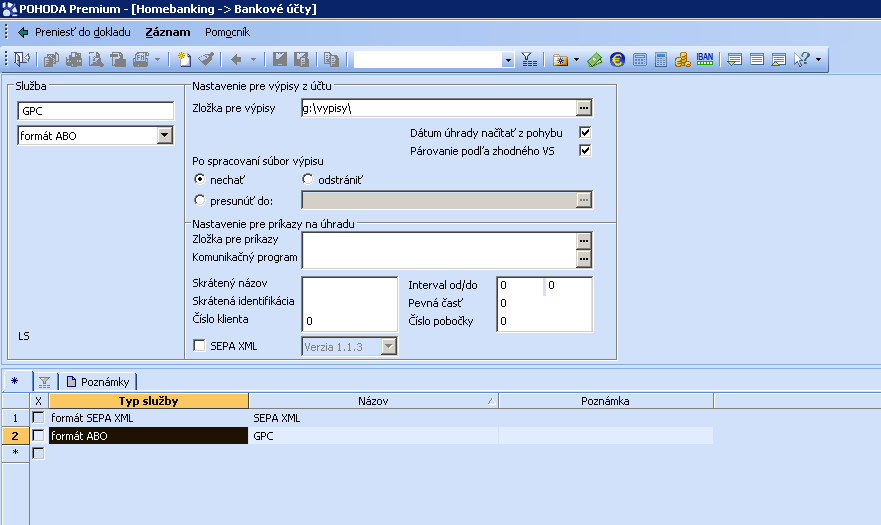

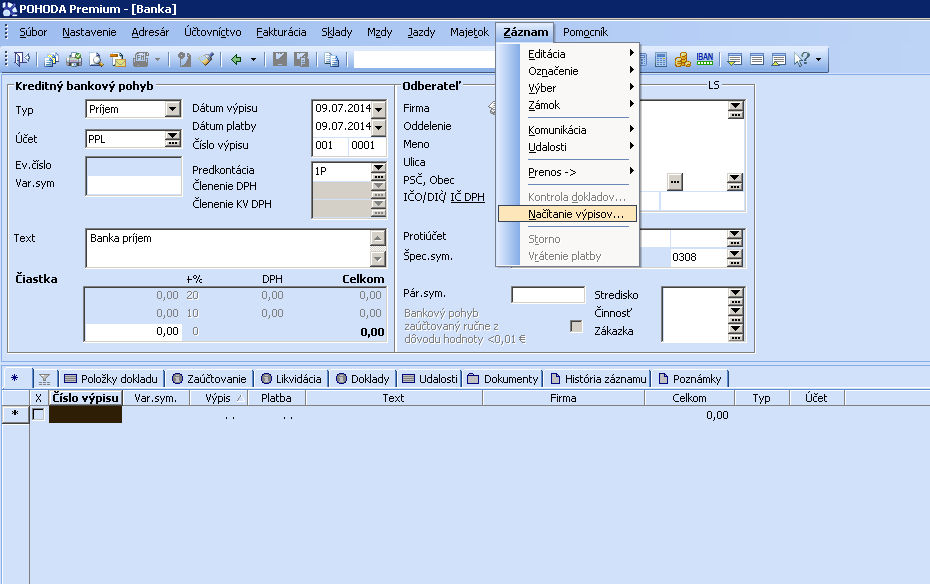

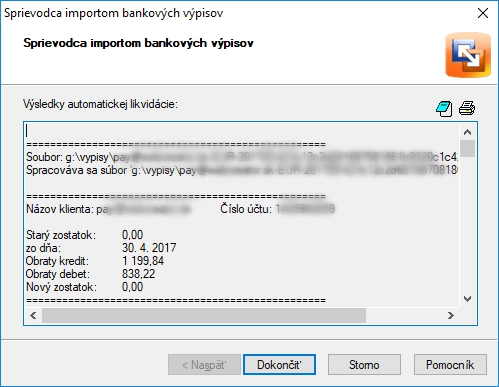

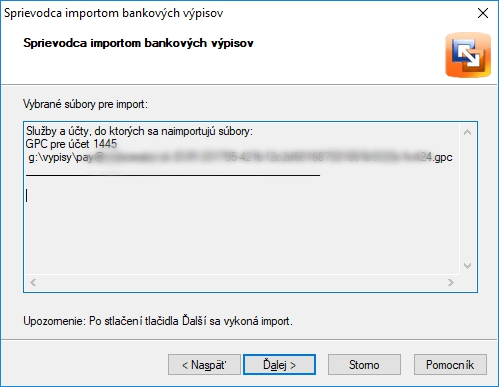

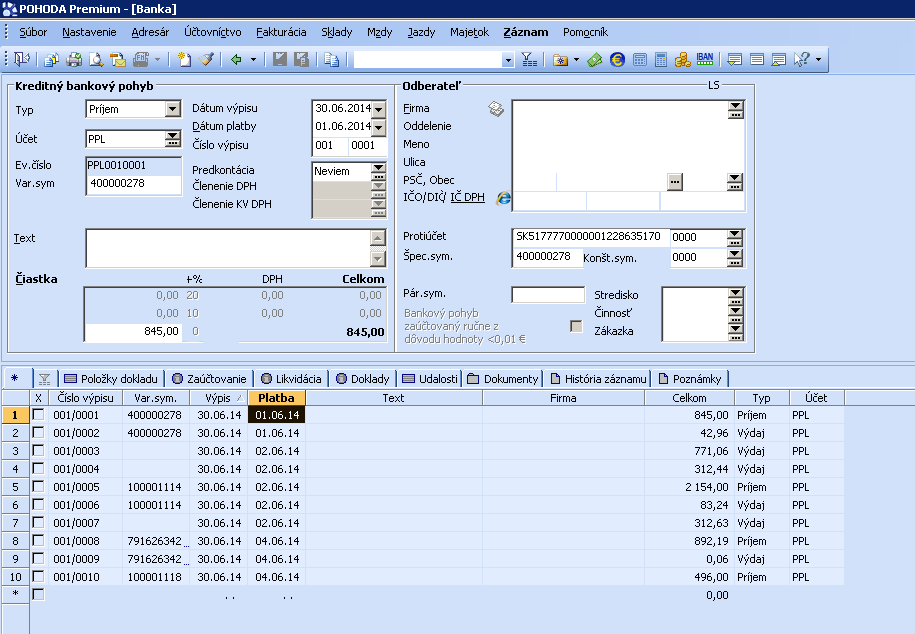

How Pohoda complements the parameters of an accounting document:

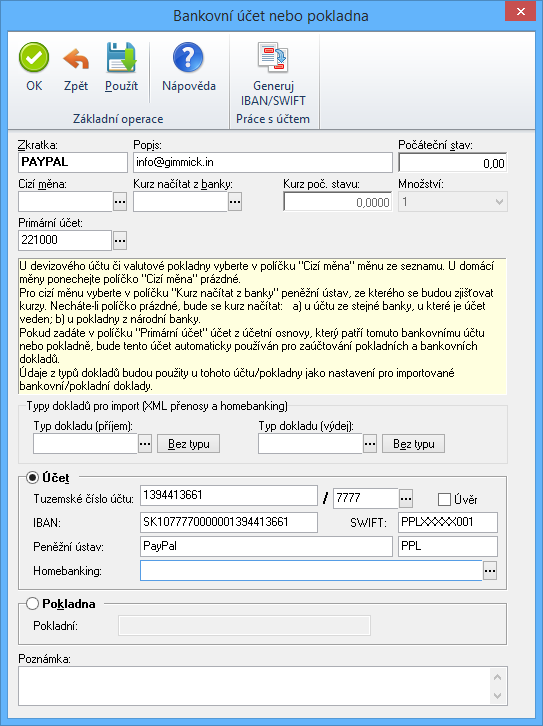

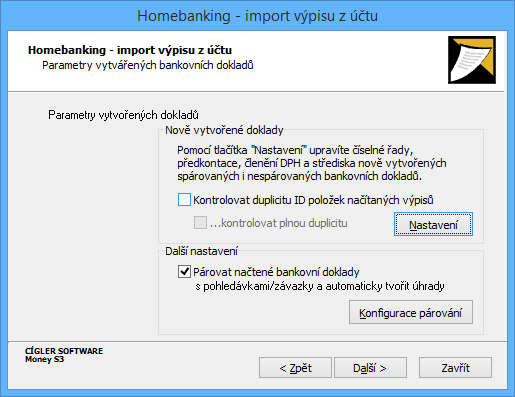

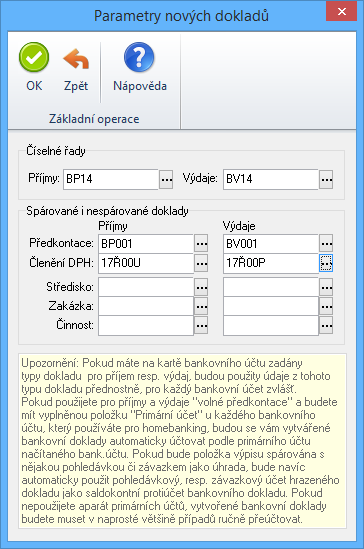

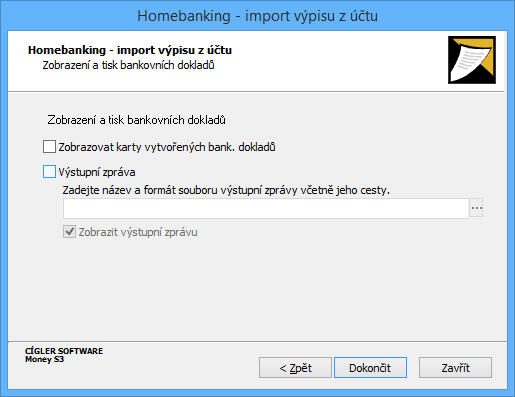

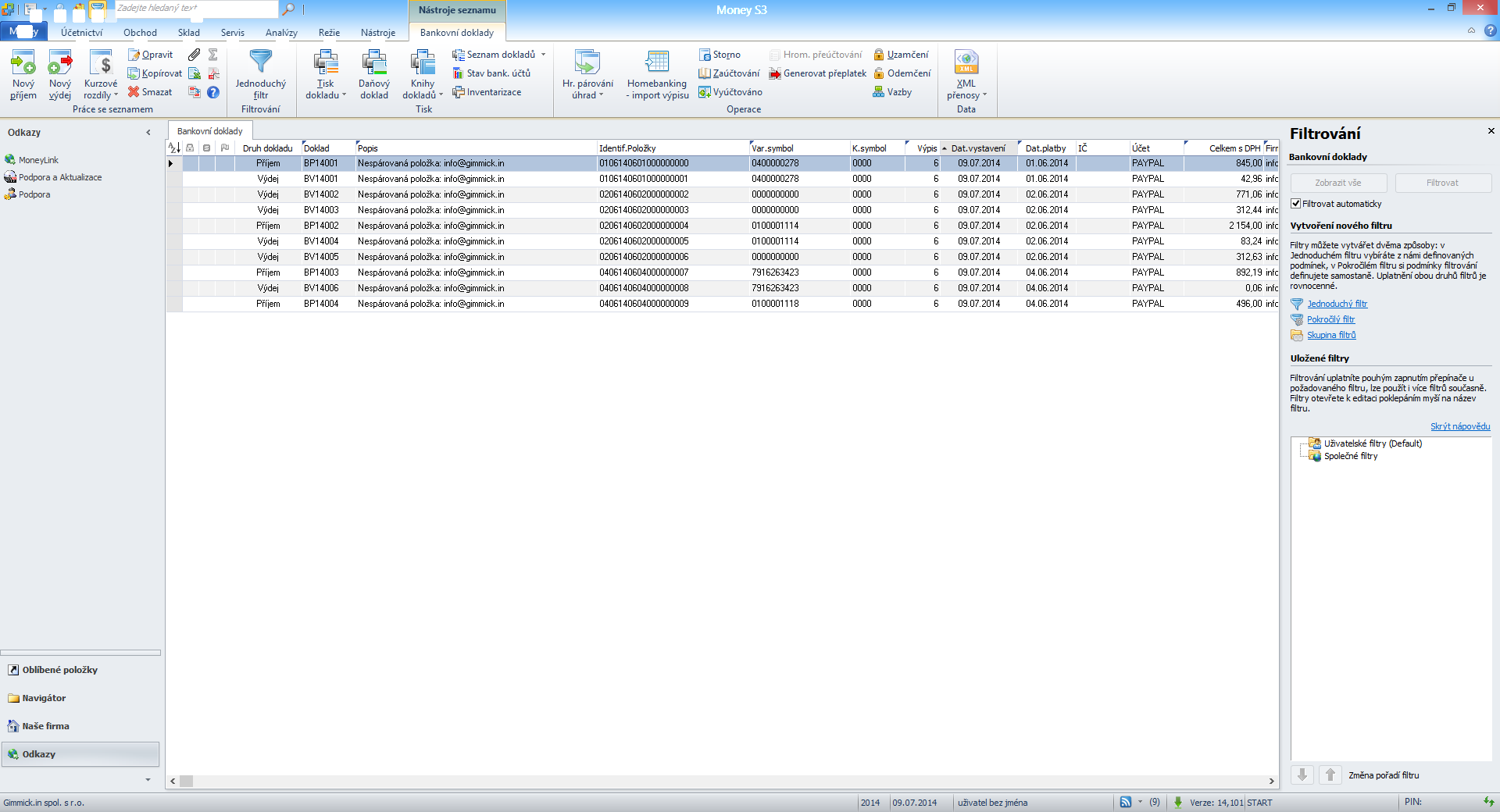

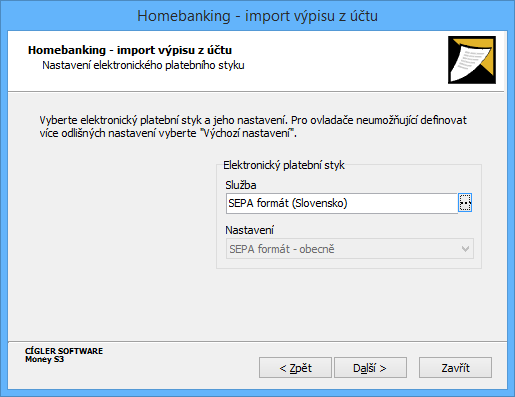

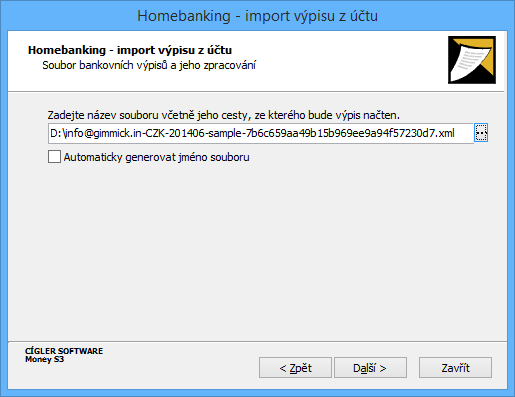

How Money S3 complements the parameters of an accounting document: